Careful Outsourcing Proves Key To Targeted Protein Degradation Drug Development

By Sourabh Mundra, Ph.D., lead analyst, Pharma R&D, and Mathini Ilancheran, research manager, R&D/IT Beroe Inc.

Targeted protein degradation (TPD) addresses the long-standing challenge of “undruggable” proteins, critical biological targets that cannot be effectively modulated using conventional approaches. Such proteins often lack well-defined binding pockets, as in transcription factors like MYC or p53; reside within cells beyond the reach of antibody-based therapies; depend on complex protein–protein interactions that are difficult to disrupt; or operate within regulatory networks where direct inhibition may compromise safety or efficacy1. Unlike traditional inhibitors that block protein function, TPD harnesses the ubiquitin–proteasome system to selectively and catalytically eliminate target proteins, overcoming the limitations of occupancy-driven drug models.2

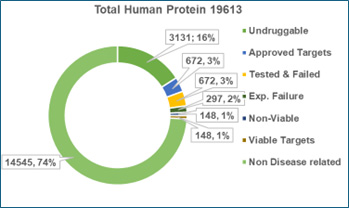

The magnitude of this opportunity becomes clear when viewed through the lens of the human proteome. Of the 19,613 proteins encoded in the human genome, ~74% show no known disease association and are excluded as viable drug targets. Among the 5,068 disease-linked proteins, 3,131 (~16% of the total proteome) remain “undruggable” due to inaccessible binding pockets or incompatibility with large molecules. Only 1,937 proteins are therefore druggable, of which 672 are already addressed by existing therapies3,4. This leaves just 1,265 proteins — barely 7% of the proteome — as untapped targets for future therapies (Figure 1).

Figure 1: Human Protein Atlas classification showing segregation of targets into categories

Against this backdrop, TPD represents a paradigm shift by expanding the pool of actionable proteins and opening new therapeutic frontiers. However, translating this scientific promise into clinical success introduces considerable complexity. TPD development requires not only breakthroughs in biology and chemistry but also robust operational and procurement strategies to navigate uncharted territory. This article therefore examines the procurement landscape for TPD clinical development, highlighting emerging trends in CRO capabilities, sourcing strategies, and partnership models, while outlining best practices to mitigate risks and accelerate time-to-market.

Challenges And Opportunities With TPD

The design and optimization of TPD molecules require precise balancing of ligand affinity, specificity, and orientation to enable efficient and selective target degradation, often demanding extensive screening of E3 ligases. Intracellular delivery barriers, risk of off-target effects, potential toxicities, and emergence of resistance mechanisms add further layers of complication5,6. The proliferation of TPD platforms is stymied by several persistent obstacles such as fragmented supplier landscape, high R&D costs, regulatory uncertainty, specialist talent shortage, and supply chain risks7,8.

The limited availability of specialized TPD technologies, such as PROTACs, poses a challenge, as these compounds feature complex molecular architectures and mechanisms that extend well beyond conventional small-molecule drug discovery. As a result, the number of CROs equipped with validated platforms for TPD, including degrader screening, E3 ligase targeting, and ternary complex modeling, is limited. Developing these capabilities often requires substantial investments in structural biology and assay development, raising the entry barrier for many service providers. Many TPD candidates have progressed to Phase I and II clinical trials, the mixed pivotal data from Pfizer and Arvinas’ protein degrader ARV‑471 in breast cancer particularly its lack of efficacy in non-mutated cases has temporarily dampened investor confidence in the segment9,10. The challenges surrounding TPD procurement span multiple dimensions, each with significant operational implications.

Regulatory risks compound the problem, with ambiguous guidance and the absence of standardized IND filing pathways for TPDs increasing the likelihood of late-stage protocol changes and unexpected data requirements that can stall momentum and add millions to program costs8,11,12,13. Lastly, overreliance on external providers for core scientific competencies risks internal capability erosion, which can become particularly damaging if strategic priorities shift or rapid in-house problem-solving becomes critical.

These systemic challenges demand strategic responses. Strategic outsourcing decisions must balance cost, quality, regulatory readiness, and delivery speed, often within an evolving and fragmented supplier landscape. The following sections will propose sourcing models, supplier development frameworks, and collaborative engagement structures to help procurement balance cost, quality, speed, and innovation

Recommendations For TPD Outsourcing

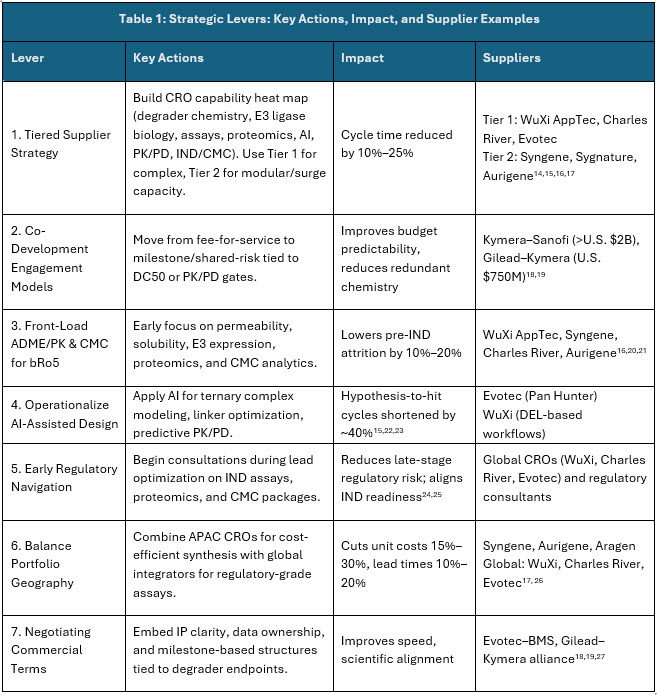

To address procurement challenges in the evolving TPD landscape, organizations must adopt procurement levers (Table 1) that not only optimize cost and compliance but also ensure scientific rigor and innovation.

A. Strategic Levers:

Sources: Secondary Articles and Beroe Analysis

Intrestingly, the aforesaid procurement levers provide the tools to manage cost, compliance, and innovation. To make these tools effective, companies must also consider the sourcing architecture itself when deciding when to rely on large CROs, when to engage niche partners, and where co-development adds the greatest value.

B. Sourcing Architecture:

- Global, Full-Service CRO Partnerships: Large CROs like WuXi AppTec, Charles River, and Labcorp provide end-to-end capabilities, from bioassays to regulatory filings, ensuring continuity, compliance, and reduced delays. With advanced bioinformatics, GLP/GMP infrastructure, and in-house toxicology/DMPK services, they are suited for complex TPD programs.

- Implementation: Best for large-scale, multi-site studies; requires service level agreements (SLAs) with clear milestones and accountability.

- Costs/Risks: Higher costs due to global infrastructure; less flexibility as standardized processes prioritize scalability.

- Niche & Regional CRO Engagement: Smaller CROs specializing in proteomics, molecular modeling, or degrader libraries, often in India, China, and Eastern Europe, offer cost savings, speed, and agility.

- Implementation: Ideal for target validation and pilot screening; procurement must vet compliance, QA, and certifications.

- Costs/Risks: Risks include variable quality, data integrity, and regulatory acceptance and weaker IP protection in some jurisdictions.

- Strategic Collaboration & Co-Development Models: Biopharma increasingly pursues co-development with CROs and academia, enabling joint IP, shared risk, and faster innovation in novel TPD targets.

- Implementation: Suited for breakthrough therapies where internal capabilities are limited; requires strong governance, trust, and agility.

- Costs/Risks: Complex contracts demand careful IP and data-sharing agreements; potential disputes over ownership require robust legal frameworks.

To effectively navigate the complexities of TPD drug development, procurement teams must adopt a hybrid sourcing strategy that balances scientific expertise, operational agility, and cost-effectiveness. The preferred approach involves a dual engagement model: leveraging global, full-service CROs for end-to-end program scale, while strategically integrating niche CROs and academic partners for high-value, discovery-phase functions.

Supporting Analysis And Evidence

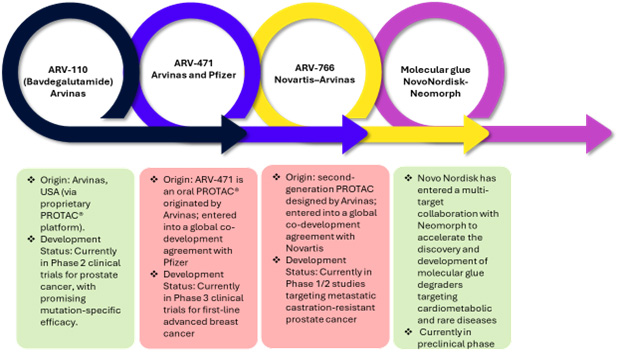

Recent data and case studies highlight the rapid evolution and expanding potential of TPD technologies, driven by robust collaborations between academia, biopharma, CROs, and technology providers. Arvinas and Pfizer are jointly developing ARV-471 for breast cancer28, while Arvinas independently is advancing ARV-11029, currently in Phase 2 trials for prostate cancer, demonstrating promising mutation-specific efficacy. Novartis has licensed ARV-766 to expand the reach of next-generation PROTAC therapies30 and Novo Nordisk partners with Neomorph to develop molecular glue degraders for cardiometabolic and rare diseases31. An overview of these innovations is presented in Figure 2.

AstraZeneca has partnered with Pinetree Therapeutics to develop EGFR-targeted degraders aimed at overcoming drug-resistant tumors32. Early-stage innovation is also emerging globally for instance, CPS2, a CDK2 degrader developed at Tsinghua University, targets previously “undruggable” proteins, while SD-36 from the University of Michigan selectively degrades the STAT3 transcription factor33, 34. Momentum is also reinforced by landmark deals. Gilead Sciences and Kymera Therapeutics have formed an exclusive option and licensing agreement to develop novel oral molecular glue degraders (MGDs) against CDK2, a driver of tumor growth in breast and other solid cancers35. Unlike traditional inhibitors, these MGDs trigger the degradation and clearance of CDK2, potentially offering greater precision and safety. Clinically, BeiGene’s BGB-16673, a BTK degrader, entered Phase 3 trials in 202525, adding to the growing pool of late-stage assets. Strategic partnerships continue to signal strong confidence in the modality, with the Evotec–BMS alliance expansion generating $50 million to $75 million in milestone inflows and the Kymera–Sanofi alliance carrying a deal value of over $2 billion18,19,27.

Figure 2: Overview of TPD technologies

Sources: Secondary Articles and Beroe Analysis

Technology adoption is further reshaping the sector: 75% of life sciences executives report implementing AI in the past two years, and 86% plan further expansion, underscoring its pivotal role in accelerating pipelines and guiding decision-making23. By mid-2025, the strength of the field is evident in its pipeline depth: approximately 655 assets across 382 companies in active development,36 while Beacon tracks 2,346 assets, a 16% year-on-year increase, highlighting the accelerating pace of innovation37.

WuXi AppTec, a global CRO, is a seasoned partner in this space, collaborating with over 150 companies throughout all stages of TPD compound development38. Other CROs, including Charles River Laboratories, Evotec, Sygnature Discovery, Aurigene, and Syngene, have established integrated platforms combining degrader design, pharmacokinetic profiling, and AI-driven predictive modeling, further accelerating innovation.

What Lies Head For TPD

The success of TPD programs hinges on a strategic, innovation-driven approach that integrates partnerships, resilient supply chains, digital enablement, regulatory foresight, and specialized talent. By moving beyond transactional procurement, organizations can reduce R&D risks, accelerate time-to-market, and capture early-mover advantages in high-value therapeutic areas. Strong multi-stakeholder collaborations, diversified supplier networks, and advanced digital and regulatory capabilities form the foundation for sustained growth. Procurement and market intelligence teams play a pivotal role by mapping specialized suppliers, monitoring industry partnerships, assessing risks, and enabling agile, informed decision-making that aligns with therapeutic innovation priorities and ensures resilient supply chains.

References:

- G. Zhong, X. Chang, W. Xie, X. Zhou, “Targeted protein degradation: advances in drug discovery and clinical practice,” Nature Communications, vol. 9, no.1, p. 308, 2024.

- R. Kamaraj, S. Ghosh, S. Das, S. Sen, P. Kumar, M. Majumdar, R. Dasgupta, S. Mukherjee, S. Das, I. Ghose, P. Pavek, M. P. Raja Karuppiah, A. A. Chuturgoon, K. Anand, “Targeted Protein Degradation (TPD) for Immunotherapy: Understanding Proteolysis Targeting Chimera-Driven Ubiquitin-Proteasome Interactions,” Bioconjugate Chemistry, vol. 35, no. 8, pp. 1089–1115, 2024.

- Oprea, T. I., Bologa, C. G., Brunak, S., Campbell, A., Gan, G. N., Gaulton, A., ... & Jadhav, A., “Unexplored therapeutic opportunities in the human genome,” Nature Reviews Drug Discovery, vol. 17, no. 5, pp. 317–332, 2018.

- K. Stott, "Pharma's broken business model - Part 2: Scraping the barrel in drug discovery," LinkedIn, 2024.

- D. Pliatsika, C. Blatter, and R. Riedl, "Targeted protein degradation: current molecular targets, localization, and strategies," Drug Discovery Today, vol. 29, no. 11, 2024.

- G. Zhong, X. Chang, W. Xie, and X. Zhou, “Targeted protein degradation: advances in drug discovery and clinical practice,” Signal Transduct. Target Ther., vol. 9, p. 308, Nov. 2024.

- N. I. Sincere, K. Anand, S. Ashique, J. Yang, and C. You, "PROTACs: Emerging Targeted Protein Degradation Approaches for Advanced Druggable Strategies," Molecules, vol. 28, no. 10, p. 4014, May 2023.

- C. Hong, Z. Tianyi and H. Yuanjia "Global landscape of PROTAC: Perspectives from patents, drug pipelines, clinical trials, and licensing transactions," European Journal of Medicinal Chemistry, vol. 299, pp. 118055, 2025.

- Life sciences industry faces setbacks: The impact of failed clinical trials in 2024," BioSpectrum Asia, 2025.

- Hotly anticipated late-stage data from VERITAC-2 study," FirstWord Pharma, 2025.

- National Academies of Sciences, Engineering, and Medicine, The Role of NIH in Drug Development and Its Impact on Patient Access: Proceedings of a Workshop, Washington, D.C., USA: The National Academies Press, 2019.

- Unlocking the undruggable with targeted protein degradation," BioSpectrum Asia.

- G. Zhong, X. Chang, W. Xie et al., “Targeted protein degradation: advances in drug discovery and clinical practice,” Signal Transduction and Targeted Therapy, vol. 9, art. no. 308, 2024.

- WuXi AppTec, “Targeted Protein Degradation CRO platform,” Company Website, 2024.

- Evotec, “PanOmics and PanHunter for TPD discovery,” Company Website, 2024.

- Charles River, “Targeted Protein Degradation Services,” Company Website, 2024.

- Syngene International, “End-to-end PROTAC services,” White paper, 2024.

- D. Tracy, “Gilead, Kymera launch collaboration on novel oral CDK2 degraders for solid tumors,” PharmExec, 25 June 2025.

- Kymera Therapeutics, “Partnerships with Sanofi and Gilead,” Investor Presentation, 2025.

- U.S. FDA, “IND CMC requirements for novel modalities,” Guidance Document, 2024.

- Aurigene, “PROTAC synthesis and degrader biology capabilities,” Corporate Brochure, 2024.

- Axios, “AI adoption in life sciences accelerates,” Market Report, 2024.

- Reuters, “NAMs and AI reduce cycle times in drug discovery,” Industry Analysis, 2024.

- M. Campone, M. De Laurentiis, K. Jhaveri, X. Hu, S. Ladoire, A. Patsouris, C. Zamagni, J. Cui, M. Cazzaniga, T. Cil, K. J. Jerzak, C. Fuentes, T. Yoshinami, A. Rodriguez-Lescure, A. Sezer, A. Fontana, V. Guarneri, A. Molckovsky, M.-A. Mouret-Reynier, U. Demirci, Y. Zhang, O. Valota, D. R. Lu, M. Martignoni, J. Parameswaran, X. Zhi, and E. P. Hamilton, “Vepdegestrant, a PROTAC estrogen receptor degrader, in advanced breast cancer,” N. Engl. J. Med., vol. 393, no. 6, pp. 556-568, Aug. 7, 2025, doi:10.1056/NEJMoa2505725.

- “A Study of ARV-463 in Subjects With Metastatic Castrate-Resistant Prostate Cancer (NCT05006716),” ClinicalTrials.gov, U.S. National Library of Medicine

- Sygnature Discovery, “Targeted Protein Degradation assay platforms,” Scientific Poster, 2024.

- Evotec, “BMS alliance expands molecular glue partnership,” Press Release, 2025.

- Hamilton E. P., Ma C., De Laurentiis M., Iwata H., Hurvitz S. A., Wander S. A., Danso M., Lu D. R., Perkins Smith J., Liu Y., Tran L., Anderson S., Campone M., “VERITAC-2: a Phase III study of vepdegestrant, a PROTAC ER degrader, versus fulvestrant in ER+/HER2- advanced breast cancer,” Future Oncology, vol. 20, no. 32, pp. 2447-2455, July 2024.

- "Arvinas' PROTAC® protein degrader bavdegalutamide (ARV-110)," Arvinas News Releases.

- “Arvinas enters transaction with Novartis, including global license,” Arvinas

- Novo Nordisk and Neomorph enter molecular glue degrader partnership worth over $1.4bn," PMLiVE, Sept. 2025.

- “AstraZeneca Strikes $45M EGFR Deal with Pinetree,” Synapse by PatSnap, 2025.

- L. Wang, X. Shao, T. Zhong, Y. Wu, A. Xu, X. Sun, H. Gao, Y. Liu, T. Lan, Y. Tong, X. Tao, W. Du, W. Wang, Y. Chen, T. Li, X. Meng, H. Deng, B. Yang, Q. He, M. Ying, and Y. Rao, "Discovery of a first-in-class CDK2 selective degrader for AML differentiation therapy," Nat. Chem. Biol., vol. 17, no. 5, pp. 567–575, May 2021, doi: 10.1038/s41589-021-00742-5.

- H. Zhou, L. Bai, R. Xu, Y. Zhao, J. Chen, D. McEachern, K. Chinnaswamy, B. Wen, L. Dai, P. Kumar, C.-Y. Yang, Z. Liu, M. Wang, L. Liu, J. L. Meagher, H. Yi, D. Sun, J. A. Stuckey, S. Wang, "Structure-Based Discovery of SD-36 as a Potent, Selective, and Efficacious PROTAC Degrader of STAT3 Protein," J. Med. Chem., vol. 62, no. 24, pp. 11280–11300, Dec. 2019.

- "Gilead Sciences and Kymera Therapeutics Enter Into Exclusive Option and License Agreement to Develop Novel Oral Molecular Glue CDK2 Degraders," Gilead.com, June 24, 2025.

- OmicsX Intelligence, “Global TPD Pipeline Landscape, 2025.

- Beacon Intelligence, “Targeted Protein Degradation Pipeline Tracker, H1 2025.”

- Stat News, "The end of the undruggable: Targeted protein degradation therapies open new frontiers in cancer care," July 21, 2025.

About The Authors:

Sourabh Mundra, Ph.D., is a lead analyst with over nine years of experience in research & analytics, market & competitive intelligence and strategic planning in the pharmaceutical and healthcare verticals. He has led numerous market research projects, leveraging both quantitative and qualitative insights to support global pharmaceutical companies make informed strategic decisions, optimize category management, and strengthen R&D planning to drive business development.

Sourabh Mundra, Ph.D., is a lead analyst with over nine years of experience in research & analytics, market & competitive intelligence and strategic planning in the pharmaceutical and healthcare verticals. He has led numerous market research projects, leveraging both quantitative and qualitative insights to support global pharmaceutical companies make informed strategic decisions, optimize category management, and strengthen R&D planning to drive business development.

Mathini Ilancheran is an expert in market intelligence and industry analysis, specializing in delivering strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 35+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.

Mathini Ilancheran is an expert in market intelligence and industry analysis, specializing in delivering strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 35+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.