Challenges And Opportunities Of Outsourcing Biopharma Development

By Williams Olughu, Ph.D., Ipsen

An earlier part of this review discussed different outsourcing models. If you haven’t read it, I encourage you to go back and familiarize yourself with them. It sets the scene for the below focus on managing challenges and opportunities associated with outsourcing in drug development.

Challenges Of Outsourcing

Quantifying the value of outsourcing remains difficult due to the dearth of available data locked behind sponsors’ firewalls, and even decision-makers within these organizations cannot access useful information due to poor data quality.1 Hence, subjective intuitions and the fear of missing out also contribute to most sponsor companies’ outsourcing decisions. Before highlighting common challenges to outsourcing, let’s consider two insights.

This is the second of a two-part review of outsourcing strategies and challenges. Click here to read about some of the outsourcing framework types.

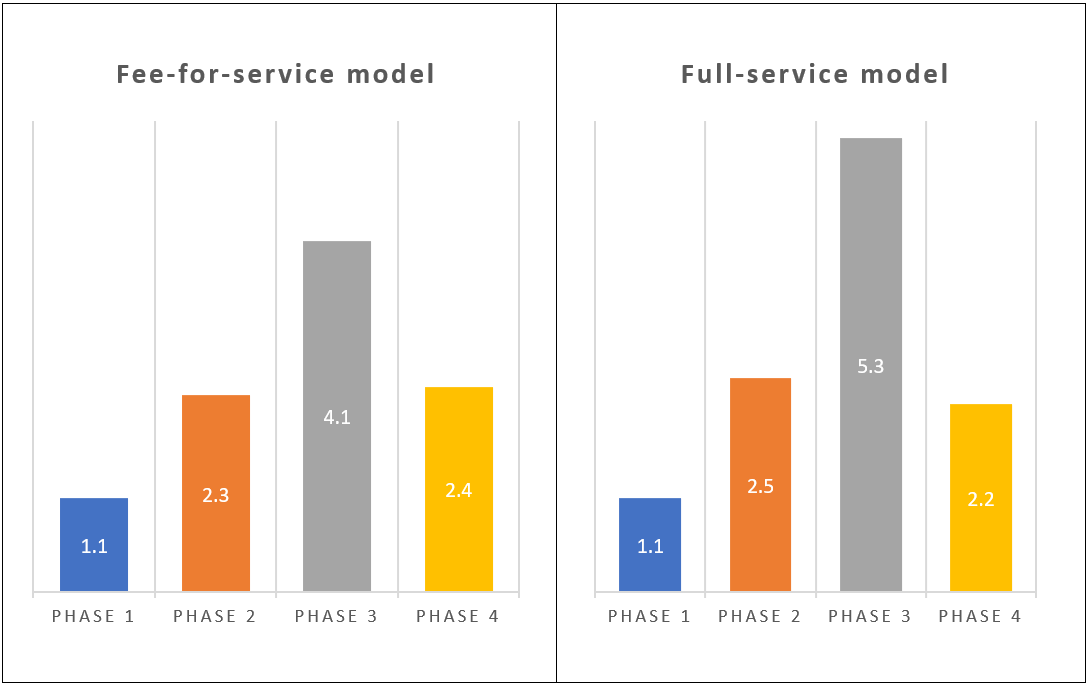

- Consider the number of change orders as a performance indicator a sponsor company would ideally want to minimize in any third-party relationship due to its administrative burden, cost, and proxy for communication efficiency. Thus, conceptually, a strategic outsourcing relationship such as the full-service model should have considerably fewer change orders than the fee-for-service model. However, when sponsor companies were surveyed (Figure 1), no significant difference was seen when both models were compared across the clinical development phases.2

Figure 1. Frequency of change orders between fee-for-service and full-service models across clinical development phases 2

Even with the limited data set from Figure 1, sponsors would be better off considering more rigor in the model or combination of outsourcing models they adopt. Figure 1 shows that perceived advantages do not necessarily materialize in practice, and an outsourcing model’s popularity (full-service model) does not infer efficiency.

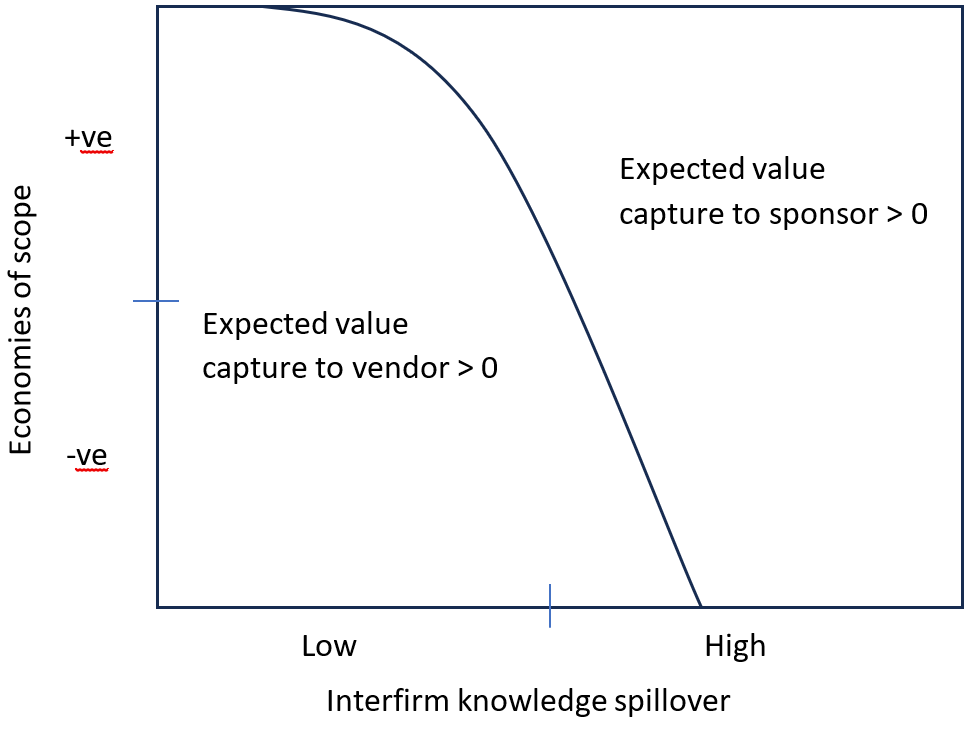

- The “value-capture-paradox” concept refers to the unresolvable conflict of interest between the sponsor and service provider, regardless of the outsourcing model. Fundamentally, no win-win scenario exists in any outsourcing relationship because excess value is mutually exclusive and accrues to the vendor or sponsor.3 In other words, projects with little or no innovation disproportionately favor the service provider, while innovative projects with interfirm knowledge spillover benefit the sponsor (Figure 2).

Figure 2. Value-capture-paradox indicating the unresolvable conflict of interest between sponsor and vendor. Economies of scope refers to the decrease in the unit cost or the increase in quality to deliver an activity resulting from a contract organization taking on an additional project, while the interfirm knowledge spillover occurs when a vendor uses substantial know-how from a prior project to deliver on a new project.11

Figure 2 shows that the incentive to enter an outsourcing relationship differs for the sponsors and service providers. Thus, it is essential that engaged parties systematically consider how much upside and downside they might incur before sanctioning outsourcing a project or providing services.

However, once the decision to outsource is reached, typical challenges can be classed into three key areas: oversight deficiencies, knowledge management issues, and operational/compliance risk.

Oversight deficiencies

The complexity of selecting the right third-party service provider, monitoring performance, and effectively managing the service they provide is significant. In certain scenarios, this management cost might exceed the alternative of maintaining in-house facilities.4

Communication across different teams within the sponsor and vendor organization is necessary to deliver on the agreed project. Consequently, it is not uncommon for collaborating teams to be geographically separated by different time zones, which could easily promote inefficiencies in communication.1,5 These inefficiencies become more visible when unexpected events occur and the roles and responsibilities are unclear.2

Sponsor companies frequently struggle to coordinate and integrate multiple service providers and outsourcing models, leading to internal friction and inefficiencies.1,2 This situation is further exacerbated when internal mechanisms to identify and resolve integration frictions are not correctly implemented, thus creating wastage. In addition, the combination of transactional and strategic relationships increases the probability of incoherent priorities.2

Middle managers typically oversee outsourcing within sponsor companies, which might skew focus to reactive and tactical matters. Consequently, opportunities to leverage the full advantages of strategic collaboration are reduced, due to a lack of engagement from executive-level involvement.1

Knowledge management issue

Outsourcing tends to fragment the end-to-end knowledge of a drug life cycle, which might weaken a sponsor’s in-house R&D capabilities and their “learning by doing” processes.4 This issue is especially relevant when the relationship model is transactional and the main aim is cost reduction. This loss of internal expertise and know-how is even more acute when a sponsor’s service provider activities occur in a geographically different region, which inherently increases communication barriers and decreases knowledge-sharing.6,7

Even in cases where there is significant knowledge-sharing from a service provider, the sponsor might have a limited absorptive capacity to integrate this knowledge and transfer it to other development portfolios.2,3 Thus, value is lost, reducing potential benefits from such an external relationship.

Also, the type of relationship model between vendor and sponsor might cause staff to overly focus on completing specific tasks without an appreciation of the impact of their work or the upstream effect on their work. This lack of understanding of the broader picture tends to be demotivating and negatively affects the quality of work.4

Outsourcing, especially in early development, brings concerns about intellectual property (IP) to the fore.7 Questions on who owns IP generated during a project must be resolved, and ensuing IP agreements tend to be complex and time-consuming.6 In addition, the anxiety of losing control over intellectual assets and the potential misuse of IP by a third party hardly wanes. 5

Operational/compliance risk

Business insolvency and operational instability are associated risks when dealing with third-party suppliers.4 Geopolitical tensions could also destabilize a project, especially when the relationship between the origin countries of sponsor and vendor is fraught. The added layer of a vendor as an intermediary could obfuscate supply chain vulnerabilities from the sponsor’s perspective, resulting in underestimating the risk of critical materials availability.

The collaboration between the sponsor and service provider makes data management more complex. Managing sensitive data sets requires compartmentalization, and real-time and restricted access to relevant persons while maintaining data integrity, safety, and compliance.8 Thus, if significant differences exist in the data handling infrastructure across both firms, the probability of a data breach or potential for error significantly increases.

Implementing good manufacturing practices and adapting to changes in regulatory requirements are crucial for success. However, the maturity level of quality systems differs in all organizations. Outsourcing brings the challenge of harmonizing quality standards across companies with different cultures and experiences.9 This discrepancy compounds when multiple vendors with varied compliance capacities are engaged by a sponsor to execute a project. This situation is typically seen when issues arise, and it becomes clear that the approach to investigating and identifying root causes tends to be vastly different across organizations, with potential impact on timelines, cost, and product quality.

These challenges are pertinent in every outsourcing model, and successfully delivering a project involves good management and understanding the nuance of collaborating with a third party, which opens up opportunities for further innovation.

Opportunities And Future Direction

Advanced technologies, evolving business models, and the greater need for efficiency will continue to shape the pharmaceutical outsourcing landscape.10 Some of the areas to be impacted by these drivers are as follows:

Digitalization and data management

The quantity of data generated from both research and clinical activities will continue to increase, so it becomes crucial that organizations embrace more automation and digitalization to stay competitive. They will require digital tools and data analytics to obtain real-time and actionable insights for decision-making from the data deluge.1 Digital platforms would ensure that routine tasks are easily automated, collaboration is enhanced, and potential issues (quality, manufacturing, etc.) are identified much earlier before negatively impacting a project. Once collaborative platforms are embedded, data and workflows between companies will be simplified, increasing visibility and project management.11 Companies leverage artificial intelligence and machine learning to accelerate drug discovery and identify targets and biomarkers. The positive impact on timelines from discovery to market will manifest as these technologies proliferate.

Changing partnerships and collaboration

Integrated partnerships will continue to dominate as sponsors move from transactional to strategic relationships with service providers. Preferred networks might become popular, where sponsors maintain a core of vetted contract organizations they preferentially work with to deliver projects.1 If well-managed, this shift to the strategic partnership model should deliver on the promise of higher quality, efficiency, and innovation. As mergers and acquisitions play out, vendors will focus on areas of differentiation to stand out, highlighting competencies in specific areas with leading-edge know-how, equipment, and technology that give them a competitive edge. Such increased competency profile transparency would enable sponsor companies to streamline how they select partners, consequently increasing a potential project’s viability.12 Also, stakeholders will continue to explore collaborative models where they share risks and rewards early in drug discovery and development, and as these sorts of partnerships predominate, the industry threshold for risk should increase, bringing more life-saving medicines to the market.2

Addressing market and regulatory needs

The global market for contract providers is expected to grow due to rising demand, which will be met by increasing capacity and infrastructure efficiencies to deliver on myriad projects.1 Service providers will need to be adept at balancing scale and flexibility to manage unique project requirements, given the new therapies of the future.6 The sponsor company size will dictate the type of outsourcing relationship sought, and vendors will either be niche or agile in their offerings to clients.7 For contract organizations to stay competitive in an increasingly stratified market, they need to improve two-way communication, reliable delivery, and responsiveness, as sponsors see these as essential for any outsourcing relationship.4

A deep understanding of the global regulatory landscape will be requisite for vendors, as sponsor regulatory submissions will increasingly be global. Future regulation will transition from basic GMP compliance to focus on data integrity and quality metrics, and successful companies will have integrated tools to accommodate this shift.1,8 All stakeholders would have to be adept at navigating the various electronic submission platforms and aligning their data generation and formatting to enable successful submissions and applications.11

Conclusion

The growth of outsourcing in the pharmaceutical industry will remain shaped by cost pressures, the need for expertise, and capacity fluctuations. For companies to benefit from outsourcing relationships, there must be a hard-nosed evaluation of the pros and cons that inherently arise from R&D externalization. Companies seeking to thrive must move beyond short-term cost-reduction activities to more integrated partnerships that emphasize productivity, quality, and innovation. The era of entering into barely considered partnerships based on subjective reasons will be grossly disadvantageous as competition becomes fiercer. Ultimately, all parties entering into external partnerships must understand that incentives do not always align regardless of the outsourcing model, as highlighted by the value-capture-paradox, and decision-makers must adjust accordingly. The importance of data integrity, automation, and advanced technologies cannot be overstated, and only companies that optimally integrate the resulting tools will stay competitive. Only by addressing the challenges highlighted here, will pharmaceutical companies competently navigate the complexities of outsourcing to achieve the promise of increased new therapies while maintaining high quality and regulatory compliance.

References

- M. Wilkinson, B. Harper, J. Peacock, R. Morrison, and K. Getz, “Assessing Outsourcing Oversight Practices and Performance,” Ther Innov Regul Sci, vol. 54, no. 1, pp. 158–166, Jan. 2020, doi: 10.1007/s43441-019-00040-2.

- K. A. Getz, M. J. Lamberti, and K. I. Kaitin, “Taking the pulse of strategic outsourcing relationships,” Clin Ther, vol. 36, no. 10, pp. 1349–1355, 2014, doi: 10.1016/j.clinthera.2014.09.008.

- E. Billette De Villemeur, J. W. Scannell, and B. Versaevel, “Biopharmaceutical R&D outsourcing: Short-term gain for long-term pain?,” Drug Discov Today, vol. 27, no. 11, Nov. 2022, doi: 10.1016/j.drudis.2022.08.001This.

- Wasan Himika, Singh Devendra, Reeta K. H., Gupta Pooja, and Gupta Yogendra Kumar, “Drug development process and COVID 19 pandemic: Flourishing era of outsourcing,” Indian J Pharmacol, vol. 49, no. 5, pp. 344–347, 2018, doi: 10.4103/ijp.ijp_318_22.

- B. L. Decorte, “Evolving Outsourcing Landscape in Pharma R&D: Different Collaborative Models and Factors to Consider When Choosing a Contract Research Organization,” J Med Chem, vol. 63, no. 20, pp. 11362–11367, 2020, doi: 10.1021/acs.jmedchem.0c00176.

- G. Festel, “Outsourcing chemical synthesis in the drug discovery process,” Drug Discov Today, vol. 16, no. 5–6, pp. 237–243, 2011, doi: 10.1016/j.drudis.2011.01.002.

- G. W. Festel, “The nature of outsourced preclinical research-the example of chemical synthesis,” Expert Opin Drug Discov, vol. 8, no. 9, pp. 1049–1055, 2013, doi: 10.1517/17460441.2013.806909.

- Holger Amort and Oliver Kingston, “Best Practices for CDMOs Dealing with Data Mayhem,” ISPE. Accessed: Jan. 11, 2025. [Online]. Available: https://ispe.org/pharmaceutical-engineering/ispeak/best-practices-cdmos-dealing-data-mayhem

- Nick Lucas, “Contract Research Organizations: Key Partners In The Drug Development Journey,” Forbes. Accessed: Jan. 01, 2025. [Online]. Available: https://www.forbes.com/councils/forbestechcouncil/2021/04/09/contract-research-organizations-key-partners-in-the-drug-development-journey/

- Erica Friedman, “Here’s Why Outsourcing To CDMOs Doubled In 13 Years,” Outsourced Pharma.

- F. D. C. Martin, A. Benjamin, R. MacLean, D. M. Hollinshead, and C. Landqvist, “Use of a collaborative tool to simplify the outsourcing of preclinical safety studies: an insight into the AstraZeneca–Charles River Laboratories strategic relationship,” Drug Discov Today, vol. 22, no. 12, pp. 1754–1759, 2017, doi: 10.1016/j.drudis.2017.08.007.

- “What is a CDMO & How Can CDMO Services Streamline Your Pharma Development?,” UPM Pharmaceuticals. Accessed: Jan. 02, 2025. [Online]. Available: https://www.upm-inc.com/what-is-a-cdmo

About The Author:

Williams Olughu, Ph.D., is a senior principal scientist at Ipsen Biopharmaceuticals Ltd. in the United Kingdom where he serves as the CMC technical lead for one of the company’s antibody-drug conjugate programs. He is a Royal Academy of Engineering visiting professor at Loughborough University and an editorial board member for the World Journal of Microbiology and Biotechnology and the Journal of Chemical Technology and Biotechnology.

Williams Olughu, Ph.D., is a senior principal scientist at Ipsen Biopharmaceuticals Ltd. in the United Kingdom where he serves as the CMC technical lead for one of the company’s antibody-drug conjugate programs. He is a Royal Academy of Engineering visiting professor at Loughborough University and an editorial board member for the World Journal of Microbiology and Biotechnology and the Journal of Chemical Technology and Biotechnology.